How Do You Pay for Google Ads?

There are multiple options available to pay for Google Ads, which are: manual payments, automatic payments, and monthly invoices. For the first two options, you will first need to associate a card with your Google Ads account. You can also have multiple cards associated with your account.

After registering a card (or cards) to your account, you can then start making payments to Google. The processes between paying automatically or manually are only slightly different, so we’re going to explain both at the same time:

- Log on to your Google Ads account and then click on the “Billing” icon.

- Click on Summary.

- If you’re going to pay manually, then you’ll need to follow the following process:

- Click the “Add Funds” button.

- If you haven’t yet registered the card, you need to select “Add new credit or debit card”, and then fill in the required details.

- If your card has already been registered, all you need to do is simply select it.

- With your card registered, you just need to enter the amount that you’d like to pay and then click on “Add funds” to finish the payment.

- Click the “Add Funds” button.

- On the other hand, if you’re opting for automatic payments, the process is slightly different. Since the payment would be automatic, all you need to do is register a card to your account and Google will do the rest, as so:

- Click on “Payment methods”, and then “Add new payment method”.

- Select “Credit card” and then fill in the required information.

- If you decide to make this your primary payment method, then select “Primary” from the dropdown menu in the lower left corner.

- Click “Save” and you’re done!

- Click on “Payment methods”, and then “Add new payment method”.

However, it’s good to be aware that manual payments aren’t available everywhere in the world, and there is actually a long list of countries and territories where it’s not an option. If you happen to live in one of these places, then you’ll need to opt for automatic payments.

When it comes to monthly invoices, you have two options of how to pay: either via write transfer or by mailing a physical check. If you apply for this option, then you’ll receive an invoice every month on a predetermined date (agreed upon when accepting the terms and conditions when applying for this option), and then pay Google with either of the two above payment options.

Do You Have to Pay for Google Ads?

Yes, of course you have to pay Google to advertise! Otherwise using Google Ads wouldn’t be called “paid advertising” or “pay-per-click”. In other words, paying Google to advertise your company or business (or any other paid ad platform) is pretty much how PPC marketing works.

This is opposed to some other forms of internet marketing like SEO (search engine optimization) and organic social media marketing, both of which don’t necessarily require you to spend money in order to succeed. However, when it comes to paid marketing, paying for the ads is an essential part of the process.

Corporate vs Business Credit Card

Before we get into our picks for the best credit cards for ad spend, it’s best to first explain briefly what the differences between a corporate credit card and a business credit card are because it could very well affect your choices going forward. Thankfully, however, there aren’t too many differences between the two.

In essence, both kinds of cards achieve the same thing: they are credit cards for businesses to use. However, while a business credit card is a good option for any sort of business, a corporate credit card can only be used by corporations and businesses of a significant size.

In fact, unless you meet certain strict criteria (for example, you need to have at least $4 million as annual revenue, and a minimum number of cardholding employees) you won’t be able to apply for a corporate credit card. On the other hand, business cards have laxer requirements, only requiring the owner to have a good credit score.

There are a few other differences that you also need to bear in mind: for instance, with a business credit card, only the business owner is liable; with a corporate card, it’s the whole enterprise, so even the employees can share the liability.

Finally, business cards tend to offer more rewards, discounts, and cashbacks compared to their corporate counterparts. However, with a corporate credit card, you will benefit from a top-notch customer service, going even so far as to have a personalized experience and full-time account managers with 24/7 service. This is essential when considering the scale of operations of a corporation.

Therefore, the choice between a corporate or business credit card will lie on various factors, including the size of the business, the number of employees it has, the expected spending, and the size of its transactions.

What Is the Best Card for Ad Spend for PPC?

There were many cards that we need to consider for this post, since many credit card companies, like American Express, issue a multitude of different cards, each one with its own specifications, reward programs, and other pros and cons. However, what makes one card better than another?

The best credit cards for advertising will have enticing reward programs and cashback schemes that will reward you as you spend mone on your paid advertising campaigns. Moreover, it should also have tempting welcome offers as well as low annual fees and APRs so that you don’t have factor in a great cost when picking a business card.

Before we go into the details of each individual card, let’s look at a breakdown of our picks for the best credit card for advertising:

| Card | Welcome Offer | Rewards Rate | Annual Fee | APR |

|---|---|---|---|---|

| Ink Business Preferred Credit Card | 100,000 bonus points upon spending $8,000 in the first 3 months—which is either a $1,000 cashback or $1,250 in travel rewards. | 3 points for every $1 spent on the first $150,000 every account anniversary year. Applies to purchases on specific categories, including advertising on social media and search engines. 1 point per 1$ on all other purchases (unlimited) | $95 | 21.24%–26.24% |

| American Express Business Gold Card | 70,000 Membership Rewards Points after spending $10,000 on eligible purchases in the first 3 months. | 4x Membership Rewards points when making purchases on 2 of 6 eligible categories (including marketing); 3x points on flights and prepaid hotels; and 1x points on all other purchases. | $295 ($375 if application is received on or after 2/1/24) | 19.49% – 27.49% |

| American Express Blue Business Cash Card | $250 statement credit after spending $3000 in the first 3 months. | 2% cashback on all eligible business purchases up to $50,000 per year, after which a 1% cashback applies. | $0 | 0% (18.49% – 26.49% after 1 year) |

| Capital One Spark Cash Plus | $1,200 one-time cash bonus after spending $30,000 in the first 3 months. | 2% unlimited cashback on all business purchases, with no restrictions. 5% cashback on hotels and rental cars. | $150 (refunded once spending $150,000 per year) | 0% (balance must be paid off in full every month) |

| Southwest Rapid Rewards Performance Business Credit Card | 80,000 points after spending $5,000 in the first 3 months. | 4 points/$1 on Southwest purchases; 3 points/$1 on Rapid Rewards hotels and rental cars; 2 points/$1 on local commuting purchases; internet, cable, and phone services; and social media and search engine advertising; 1 point/$1 on all other purchases. | $199 | 21.49% – 28.49% |

| Amazon Business Prime American Express Card | $125 Amazon gift card upon approval of the Amazon Business Prime American Express Card | 5% cashback or 90-Day Terms on select US purchases from Amazon; 2% cashback on US purchases on restaurants, gas stations, and wireless phone services; 1% cashback on all other purchases. | $0 | 19.24% – 27.24% |

| Stripe Corporate Card | $500 ad credit after spending $500 on Google Ads | Unlimited 1.5% cashback on all business expenses | $0 | 0% (balance must be paid off in full every month) |

Ink Business Preferred Credit Card

The first option we’re going to look at is the Ink Business Preferred Credit Card issued by Chase. This is a card that definitely has a lot going for it, starting off with the welcome bonus that offers 100,000 bonus points on the first $8,000 you spend in the first 3 months. This translates to a $1,000 cashback or $1,250 in travel rewards.

Then you have the fantastic cashback scheme that’s on offer that can definitely help you out when spending on Google Ads: you will receive 3 points on every $1 spent up to the first $150,000 you spend every year. This only counts when making purchases in either 1 of 4 categories, which are:

- Shipping purchases

- Advertising purchases made with social media sites and search engines

- Internet, cable and phone services

- Travel

Of course, since you’ll be using this card for Google Ads, you’ll accruing points like mad. When you hit that limit, you’ll receive 450,000 points, which translates to $4,500 in cash back—not bad at all! After that you’ll receive 1 point for every $1 spent without a limit. These points don’t expire so long as your account is open.

Other benefits include no foreign transaction fees; 24/7 monitoring for any suspicious purchases with your card; as well as Zero Liability so that you won’t be held responsible when unauthorized charges are made with your card.

Unfortunately, however, this card does come with an annual fee of $95 as well as an APR which varies between 21.24%–26.24%, depending on your creditworthiness and other factors. So, keep these in mind when choosing this card.

American Express Business Gold Card

The next card is the American Express Business Gold Card, which is probably one of the most obvious choices that we could have made. Let’s start off with the welcome bonus: after spending $10,000 with the AmEx Gold Card in the first 3 months of receiving it, you’ll receive 70,000 Membership Rewards Points.

Not bad at all! But the real beauty of this card is the rewards program that comes with it. Now, the rewards system is a bit complex, which is a bit of a downside in our opinion. Nevertheless, let us try and simplify for you here:

- 4 points for every $1 spent on 2 of 6 eligible categories, up to a maximum of $150,000. The 2 categories will be those services that you make use of the most. The available categories are the following:

- Purchases at US media providers for advertising in select media (online, TV, radio)

- U.S. purchases made from electronic goods retailers and software & cloud system providers

- U.S. purchases at restaurants, including takeout and delivery

- U.S. purchases at gas stations

- Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

- Purchases at US media providers for advertising in select media (online, TV, radio)

- 3 points for every $1 spent on flight and prepaid hotels book through amextravel.com.

- 1 point for every $1 spent on any other purchases.

- Up to $240/year in statement credits on purchases from FedEx, Grubhub, and Office Supply Stores.

- Up to $155/year in statement credits on Walmart+ membership.

The most enticing aspect of the rewards program is the fact that you’ll receive points for spending on online advertising. The benefit caps at $150,000 and then all other expenses on the same categories are worth 1 point for every $1 spent.

The bummer about the points you gain with this card is that you cannot seem to be able convert them into cash: instead, you’ll be able to use these points in a variety of different ways, including for booking hotels, luxury dinners, flights, etc. Why not use them to have yourself a lovely holiday? ????

Bear in mind, however, that the annual fee on this card is much higher than that of the Ink Business Preferred: $295 per year to be precise. On the other hand, if your creditworthiness is excellent you could benefit from a lower APR, as the variable APR for the Gold Card is between 19.49%–27.49%.

American Express Blue Business Cash Card

Next up is the American Express Blue Business Cash Card, which is a great option for smaller businesses since it’s catered for entities with smaller budgets. The welcome offer, for instance, exhibits this perfectly: after spending $3,000 in the first 3 months of receiving the card, you’ll receive $250 in statement credit.

Moreover, you’ll benefit from 0% APR on all purchases for the first year of registering this credit card. After the first year, a variable APR 18.49%–26.49% will start applying, so bear that in mind if you’re going to choose this card. All in all, the welcome offer is actually pretty decent. The reward program, on the other hand, is a little more enticing:

- You’ll receive 2% in cashbacks on the first $50,000 spent in the year on eligible business purchases.

- After spending $50,000, you’ll receive a 1% cashback on the rest of your eligible business purchases.

As you can see, the AmEx Blue Business Cash Card is more suited to smaller businesses that aren’t planning on spending too much throughout the year. Another benefit that you enjoy is the Expanded Buying Power. If suddenly your business needs change and you need to spend a little extra, then don’t worry, American Express has you covered.

With Expanded Buying Power, American Express allows you spend beyond your credit limit, up to a certain amount depending on various factors, such as payment history and credit record. But what is possibly the best feature of this card is that it has no annual fee. No one likes having to pay fees, and so this is a fantastic benefit in itself.

Capital One Spark Cash Plus

Another business credit card that is a great option for smaller businesses with smaller budgets is the Capital One Spark Cash Plus. However, as we shall see, it’s also a perfectly good option for larger businesses. Let’s start with the welcome offer, which is a one-time cash bonus of $1,200 after spending $30,000 after the first 3 months.

However, the major benefit of this business credit card lies in the cashback scheme that comes with it: you’ll benefit from an unlimited 2% cashback on every purchase made with no restrictions. Moreover, you’ll receive a 5% unlimited cashback on hotels and rental cars when booking through Capital One Travel.

This could be a very helpful way of recouping some of your expenses.

There are also other benefits with this card, including a flexible spending limit, which means that there is no preset limit of how much you can spend with your credit card, but a dynamic limit that changes according to your needs. Moreover, you can also add employee cards for free, whose expenses also apply for the cashback.

Now bear in mind that this card doesn’t charge an APR; however, credit balance must be paid in full every month, so make sure you don’t overspend. Finally, the Capital One Spark Cash Plus has an annual fee of $150. However, if you spend at least $150,000 in a year, the annual fee will be refunded.

Southwest Rapid Rewards Performance Business Credit Card

This next card is great for businesses that will find themselves having to travel often, and that’s the Southwest Rapid Rewards Performance Business Credit Card. This is a business credit card that offers a lot of rewards as part of its rewards program, making it a little dizzying to explain it all, but we’ll do so anyway.

First, let’s begin with the welcome offer, which is a simple 80,000 points after spending $5,000 in the first 3 months. Not too bad, huh? Now let’s get to the rewards program. Buckle your seat-belts for this one:

- 4 points per $1 spent on Southwest purchases, including flight, inflight, and Southwest gift cards

- 3 points per $1 spent on Rapid Rewards hotel and car rental partners

- 2 points per $1 spent on local transit and commuting purchases, including rideshare, passenger trains, buses, taxis, tolls, and parking lots and garages

- 2 points per $1 spent on social media and search engine advertising

- 2 points per $1 spent on internet, cable, and phone services

- 1 points per $1 spent on all other purchases made with your card

- The ability to also earn points on employee spending

- Receive 9,000 anniversary points after your Cardmember anniversary (in other words, after passing 1 year of registration)

Wow, that was quite a ride. We’re beat! As you can see, there are a lot of rewards that you can receive from using this card, especially from spending on social media and search engine adverts, which is important for our purposes here. And what’s even better is that there is no limit to how many points you can earn in the above categories.

Unfortunately, however, the points you receive aren’t convertible into cash. Instead, you can use the points for a number of other benefits, including Southwest Airlines flights, gift cards, merchandise, hotel stays, and car rentals. So, if you need to travel a lot, this card is definitely a good choice just the same!

To finish off, it’s good to keep in mind that, despite the ginormous list of rewards, there is still the issue of this card charging an annual fee of $199. At the same time, there is also a variable APR 21.49%–28.49%. Keep both of these in mind if you’re going to choose this card as they’re highly important considerations.

Amazon Business Prime American Express Card

If you were in the market for the best credit card for Amazon advertising, then we have just the card for you. Of course, this card can be used for other things and on other digital marketing platforms, but the main focus of this card is on shopping from Amazon. Let’s start with the welcome offer.

Upon registering the card, you’ll receive a $125 Amazon gift card. This might seem lackluster but as always, the real benefit of this card is in the rewards program:

- 5% cashback or 90 day terms (meaning you can pay up to 90 days later) on all purhases made on Amazon Business, AWS, Amazon.com and Whole Foods Market, up to the $120,000 spent. After which a 1% cashback applies.

- 2% cashback on purchases at restaurants, gas stations and wireless phone services purchased directly from service providers.

- 1% cashback on all other purchases.

If you run an ecommerce business that makes a lot of use of Amazon Ads, then this is definitely the card for you. You could be potentially saving a lot of money just by using this credit card for your digital advertising. Another great feature of this card is that there no foreign transaction fees.

Finally, the card doesn’t charge an annual fee, which is great, but it does have a variable APR 19.49%–27.49, so you need to keep that in mind.

Stripe Corporate Card

To finish off our ranking of the best business credit cards for paid advertising, we’re choosing the Stripe Corporate Card. This is a card designed for businesses that want to reach for the stars, or as Stripe puts it: “for fast-growing businesses”. Let’s see how well it holds up.

Let’s start off with the welcome offer this card. There is a number of rewards that you can receive once you sign up for the Stripe Corporate Card, all of which can be found here. However, the one that should interest us most is the $500 Google Ads credit that you’ll receive once spending $500.

When it comes to the rewards program, the Stripe Corporate Card offers a simplified cashback scheme that simply offers a 1.5% cashback on all business expenses, no matter what. That’s great for business, no?

You can also benefit from the lack of a preset credit limit, so that the limit of what you’ll be able to spend is calculated through your bank history and payment processing. Other great benefits include the monitoring tools and the custom spend controls, which helps with keeping an eye on what your employees are spending.

Finally, the card doesn’t impose an annual fee nor does it have any APR; however, you will need to pay off the pending credit balance in full every month. So, make sure to budget accordingly so as not to be caught out without any funds left to pay off your credit debt.

How We Picked the Best Business Credit Cards for Advertising

In order to choose the best business credit card for advertising, we had to keep a few considerations in mind. Arguably, our most important criterion was how much you could potentially receive back via the credit card’s reward program. If you could save money and/or earn freebies through paid advertising, that that’s a big win.

However, we also paid attention to things like the welcome offer, annual fees, the APR you need to pay on the money you’ve borrowed, foreign transactions fees, employee card fees, etc. All in all, we believe we’ve presented you with some fantastic choices for business credit cards for all forms of advertising.

So, no matter if you were looking for the best credit card for Facebook Ads, or for Google advertising, we believe that we have equipped you with the right knowledge to make the best decision.

However, in the next section, we’ll teach you more on what matters most when choosing your card. So, be sure to read on to find out.

How to Choose the Best Credit Card for Google Ads

Now that you’ve gone through our choices for the best credit card for ad spend, it’s your turn to decide which card is best for you. Choosing one card over another requires delication deliberation and much thought, which is why we decided to write this article in order to help you choose the best card for you.

We’ve given you all of the specifications that are important for choosing the card that’s right for you. However, just because we’ve regurgitated a bunch of specifications from the issuers’ websites, doesn’t mean that you’re any closer to actually choosing a card. You therefore need to bear in mind which specs make the biggest difference.

So, let’s get down to it:

- Welcome Offers: possibly the most enticing thing about choosing a card and that’s getting a bonus from the issuer. Certain credit card issuers will either offer 0% APR for the first year, or a bonus after spending a certain amount.

- Cashback & Rewards: however, the spec that should be even more important than welcome offers is the reward program or cashback scheme that the credit card issuer has on offer, as this can help greatly with recouping your costs.

- APR: Annual Percentage Rate (or APR for short) is the yearly interest charged for borrowing; therefore, you ought to find a card that has a low APR so as not to accrue much in extra charges.

- Issuer: naturally, you’re going to want to pick a trusted brand, which is why people often choose AmEx, Visa, etc. Moreover, make sure that the issuer is compatible with Google Ads.

- Customer Service: the customer service of the issuer is also an important thing to bear in mind, as you don’t want to be caught in a pickle and not have a knowledge customer care agent on the other end helping you out!

- Foreign Transaction Fees: if you’re going to be conducting a lot of international ad campaigns, having low or no foreign transaction fees would prevent you from having to pay fees unnecessarily.

- Other Benefits: pay attention to any other benefits that the issuer provides, like Purchase Protection, and so on.

Of course, it’s impossible to find the perfect card that will tick all of the boxes for you. You need to find a card that has the right balance of specs that will suit you and your business needs.

How to Choose the Right Budget for Your Ad Spend

This is easily considered one of the toughest questions in our business, as establishing the ideal budget is something that hinges upon many factors, such as the industry that you work in, the size of your company, and ultimately, thhe budget that you’re willing to spend.

However, thankfully, there is a lot of research that has gone into answering this question, and you can easily gain an understanding for yourself through the data that’s been compiled before going about to set any budgets!

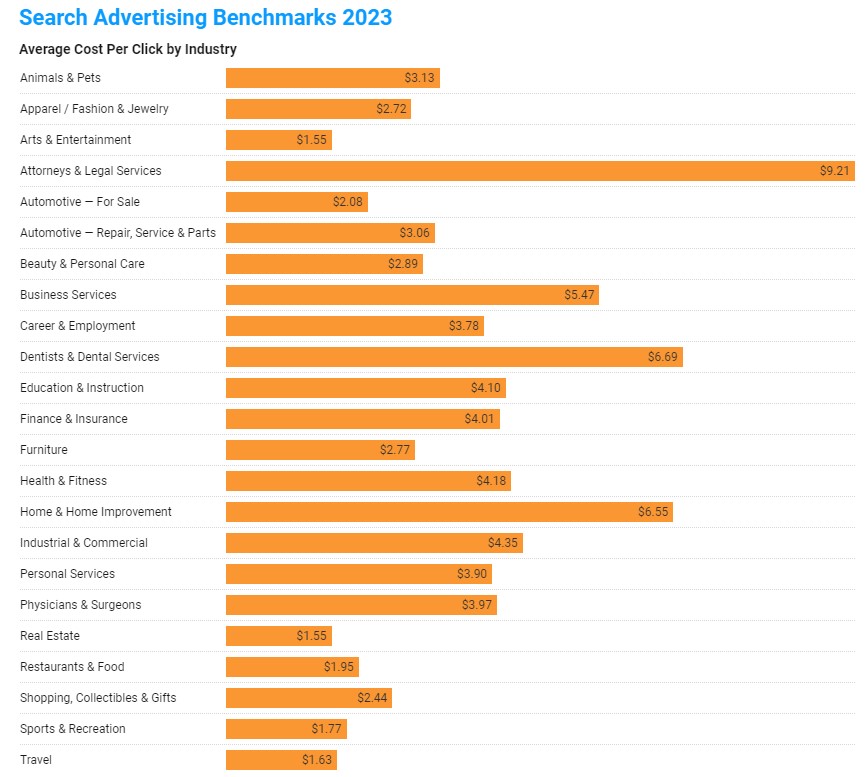

For example, there are many useful studies that you can make use of that can give you a good idea of what the average cost-per-click (CPC) is for your industry. Two great studies that you can use are those by WordStream and Mega Digital. Not only do they provide the average CPC by industry, but even other important data points too.

There are many other considerations to also keep in mind, but the most important is arguably the size of your business. The bigger your business, the more you can afford to spend on advertising. However, a good rule of thumb to bear in mind is to never exceed 15% of your revenue.

With regards to actual amounts, Google Ads specialist Claire Jarrett recommends the following:

- Small Business: $1500–$8000/per month

- Medium-sized Businesses: $7,000–$30,000/per month

- Enterprise-level Businesses: $20,000–$50,000/per month

Naturally, these are only suggestions and the actual amounts that you might need to spend might be lower or higher than the ones mentioned above, depending on your industry and goals.

FAQs

How does Google charge for ads?

There are 2 main ways that Google charges for any advertisements you make through its platform, which are: either every first day of the month, or every time you reach what is known as your payment threshold.

The payment threshold is an amount of money that, once reached, triggers an automatic payment before the first day of the next month is reached. If this happens, you’ll pay for the costs that reached the threshold; then, on the first day of the next month, you’ll pay for any remaining costs that didn’t reach the threshold.

If you don’t reach the payment threshold, then on the first day of the next month, you’ll simply be charged for any costs that you accrued over the course of a month.

Can you use a credit card for Google Ads?

Yes, absolutely. You can use either a debit or even a credit card in order to pay for Google Ads. Choosing one over the other depends on your circumstances, so choose carefully!

What is a good amount to spend on Google Ads?

This will largely depend on the size of your business, as differently sized businesses can afford different budgets. So, a big business can soak up costs much more than small businesses. Therefore, this should be a key consideration to make. However, a good rule of thumb to bear in mind is to never let your advertising costs exceed 15% of your revenue, or be below 5%.

Which credit card is best for Facebook Ads?

The best business credit card for Facebook Ads would either be the American Express Business Gold Card or else the Ink Business Preferred Credit Card. Both of these cards have cashback schemes that work with ad spend on either social media or search engines.

Does Google Ads accept virtual cards?

Yes, definitely! Using reputable virtual card issuers should pose no problem as you don’t really need to use a physical card. Virtual cards work just as well as physical cards for Google Ads.

What card can I use for Google Ads?

You have either the option of using a credit or a debit card, each one posing its own set of pros and cons. With a credit card, you’ll benefit from fantastic reward programs and cashback schemes, as well as protection measures such as Purchase Protection. However, it might prove to be easier to exceed your limit as the money is borrowed.

With a debit card, the cashback schemes and reward programs tend to be rather lackluster. However, since the money in the account is essentially yours and very finite, there is a tendency to be more careful with spending. Of course, if you deplete your account, then you are pretty much out of budget to spend.

Finally, you can also use either physical cards or even virtual ones, as virtual cards work with Google Ads just the same.

What payment method on Google Ads?

If you’re interested in knowing how to pay for Google advertising, you have 3 options: manual payment, automatic payment, and monthly invoicing. Manual payment means that you refill your account with your ad budget while automatic payment means Google will automatically charge your account when certain criteria are reached. With monthly invoicing, you’ll need to pay an invoice that you receive at a predetermined date every month.

If you’re wondering about the available Google Ads payment methods, then you have 4 options: either direct debit (Google will charge your bank account directly), credit cards, debit cards, or even PayPal.